Invest in London property wisely

You are a successful businessman who understands financial matters as professionally as real estate experts. We accept that it might be hazardous to discover excellent properties to invest in.

You are eager to gain maximum returns, long-term prospects, and confidence in your decisions. For our part, we have the perfect offer that will satisfy even the most demanding investors.

We understand your needs

- If you are looking for a rental property, we will provide detailed information on profitability in various neighbourhoods and projects.

- For those who possess the capital for a deposit but not the entire price of the equity, we propose off-plan projects with the potential to increase in value.

- If you are interested in resale, we will share the properties that can make a profit.

Don't miss your chance to make a successful investment in London property. Request a consultation with our experts now, and we will help you achieve your financial goals.

Your benefits of co-operation with us

Wide range of options. Our property database contains around 1,000 new homes in London and the surrounding areas. Together with ready-made properties, we also offer off-plan projects to diversify your investment.

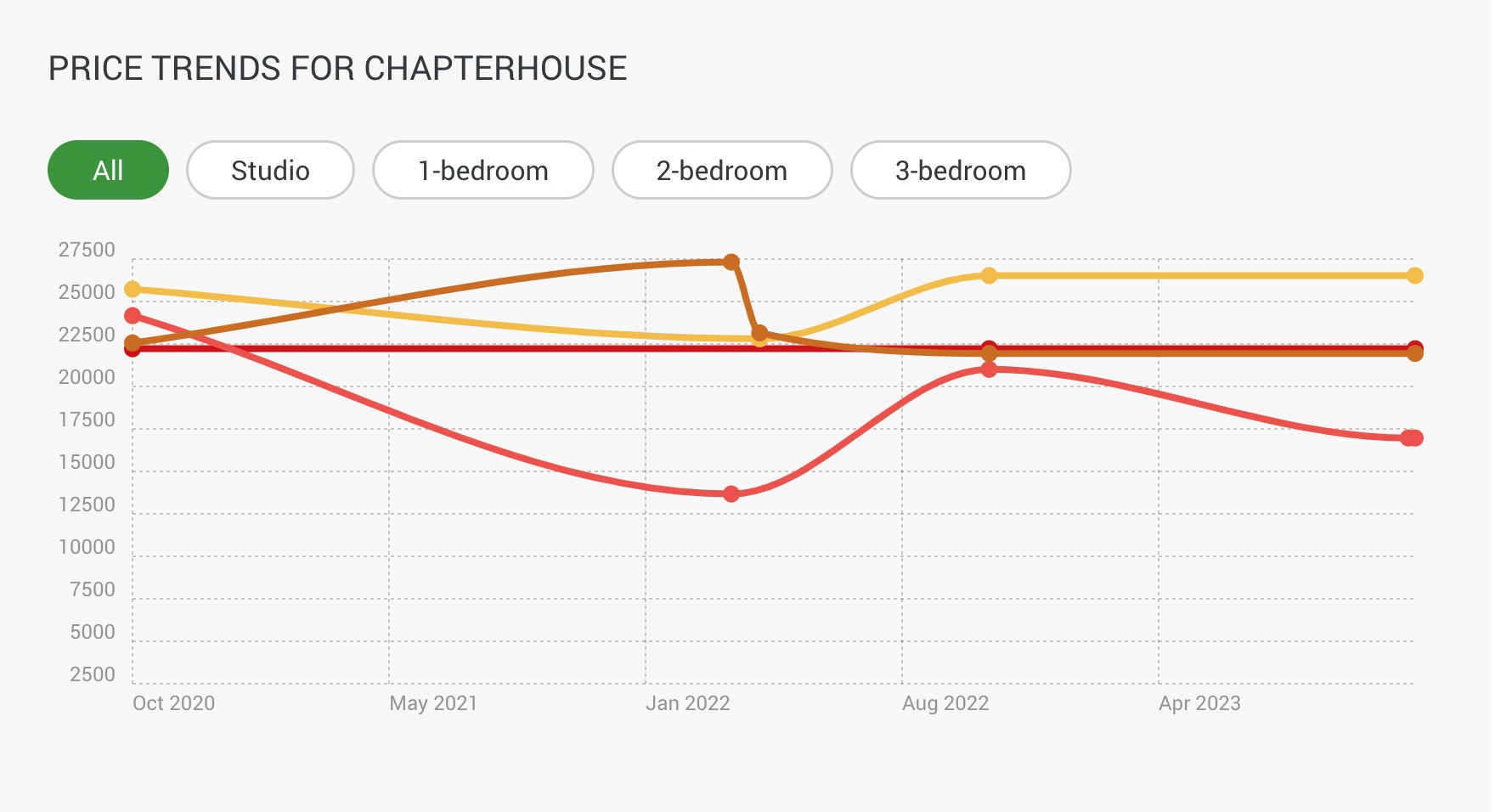

Detailed information. We provide you with all the information you need: statistics on profitability, neighbourhoods, and projects.

Personalized approach. We understand that every investor is unique. So, our team is ready to work with your criteria and budget.

Expert support. Our specialists retain extensive property expertise and are ready to answer all your questions and provide professional advice.

Variety of letting options. Whether you are planning a rental property, resale, or a long-term investment, we have outstanding properties for you.

What are you looking for?

Step 1 of 4

ready to help you

What are you looking for?

Leave a request for a property selection consultation by answering a few questions:

- What is your budget?

- What neighbourhood would you prefer to invest in?

- How many bedrooms are you looking for?

- Are there any criteria that are critical to you?

Frequently Asked Questions

FAQ

London is an attractive destination for real estate investment due to various factors. It offers economic stability as the UK's capital and a global financial hub, along with diverse investment opportunities. The city's rental market is strong, with consistently high demand for rental properties, making it appealing to buy-to-let investors.

London's property values have a track record of appreciation, driven by its international allure, diverse population, and renowned educational institutions. This creates a strong demand for property investments. Student housing and short-term rentals thrive as profitable niches, thanks to London's status as a global tourist destination.

The most profitable property to invest in London can vary depending on various factors, including your investment goals, budget, risk tolerance, and market conditions. Here are some property types that have historically shown profit potential:

- Buy-to-Let Residential Properties: Buy-to-let properties, such as apartments or houses, can offer consistent rental income in London's strong rental market. Key considerations include location, rental yield, and property management.

- Student Housing: Investing in properties near universities and colleges can be profitable due to the constant demand from students. These properties can provide stable rental income, especially in areas with a high student population.

- New Developments: Investing in new residential or commercial developments can offer potential profits, as they often come with modern amenities and may appreciate in value as the area develops.

- Luxury Real Estate: For investors with a higher budget, luxury properties in upscale neighbourhoods can offer substantial returns. As there is demand from high-net-worth individuals and expatriates.

Here are some areas and property types that historically had the potential for strong ROI in London:

- Regeneration Areas: Parts of East London, like the Docklands and Stratford, have seen significant regeneration and development projects, offering the potential for substantial capital appreciation over time.

- Emerging Regions: Up-and-coming areas, such as Brixton, Peckham, and Hackney, have shown promising growth in property values, making them potentially lucrative areas for investment.

- Commuter Belt: Areas just outside of London, like Croydon, Sutton, and Enfield, are known for more affordable property prices and can provide good rental income, especially for buy-to-let investors.

- Student Hubs: Proximity to major universities and educational institutions, such as King's Cross, provides strong rental income potential for student housing.

- Luxury Real Estate: Exclusive neighbourhoods like Chelsea, Mayfair, and Knightsbridge can offer high ROI for luxury property investors, given the demand from high-net-worth individuals.

New builds offer several advantages for first-time real estate investors. These properties typically require less immediate maintenance and have modern fixtures, enhancing their appeal to tenants. New builds often feature energy-efficient designs, leading to lower utility costs and the potential for higher rental income.

Investors can benefit from fewer renovation costs, as major updates are not immediately needed. New builds come with builder warranties, reducing financial risk, and are constructed to comply with the latest safety standards. They have the potential for capital appreciation over time, especially in high-demand areas. Lenders often favour new builds, making financing more accessible.

Several areas in London have historically attracted property investment interest. Prime Central London, including Mayfair, Knightsbridge, and Chelsea, is renowned for luxury properties and strong demand from high-net-worth individuals. It offers potential for long-term capital appreciation.

Regeneration areas in East London, such as the Docklands and Stratford, have seen significant development projects, making them appealing for potential capital growth. Southwark has also been gaining popularity due to its central location, transport links, and ongoing housing and commercial development.

Brixton, Hackney, and Camden offer vibrant and affordable property options, while Croydon's affordability and commuter-friendly location have driven investment. Islington, Ealing, and Greenwich also provide diverse investment opportunities in residential and commercial properties.

Selection of new buildings for Investors

All new homes →

-_560x376_1d0.jpg)